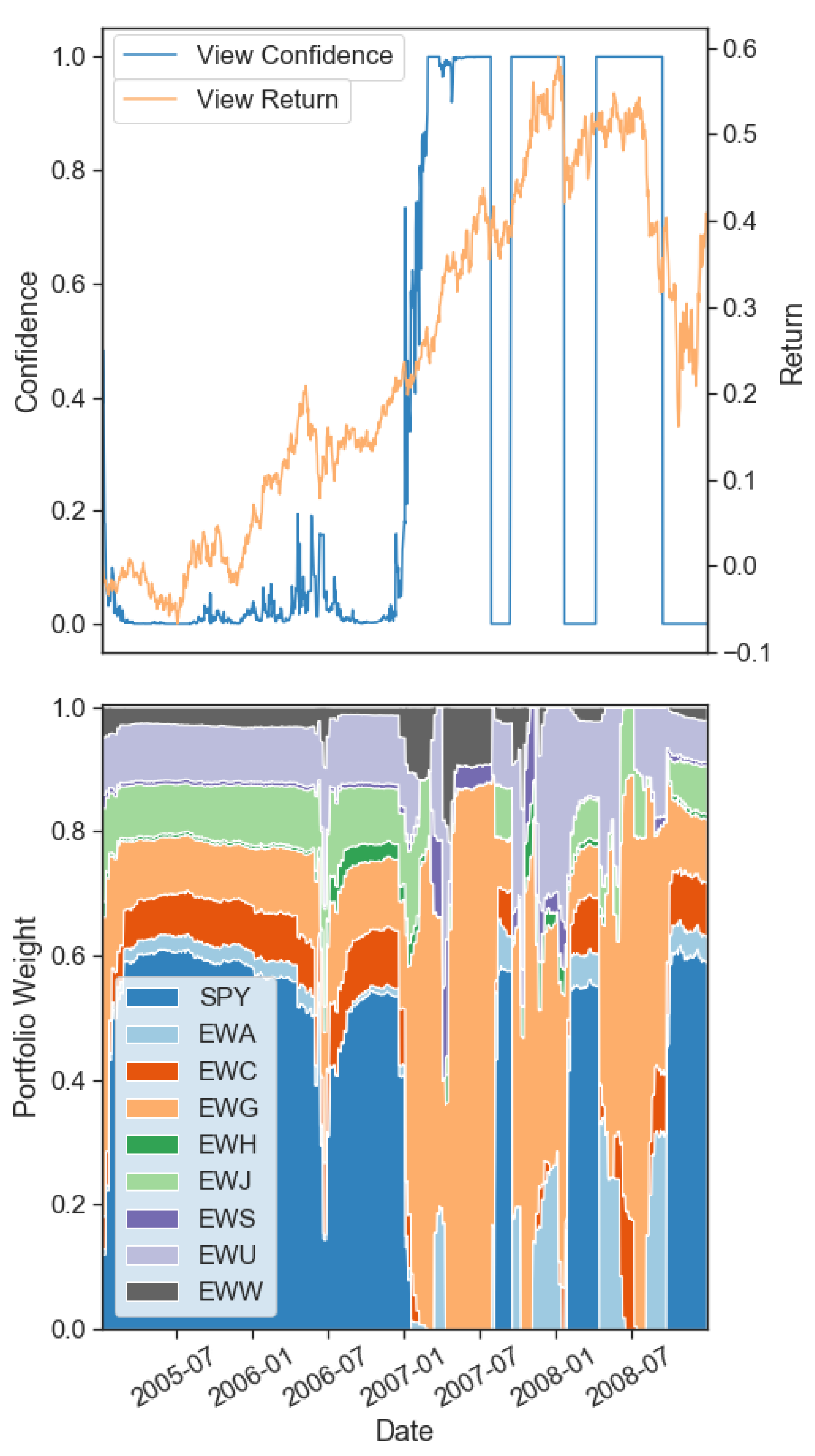

JRFM | Free Full-Text | Multi-Period Portfolio Optimization with Investor Views under Regime Switching

Fundamental Factor Long/Short Strategy with Mean Variance Portfolio Optimization by Jing Wu - QuantConnect.com

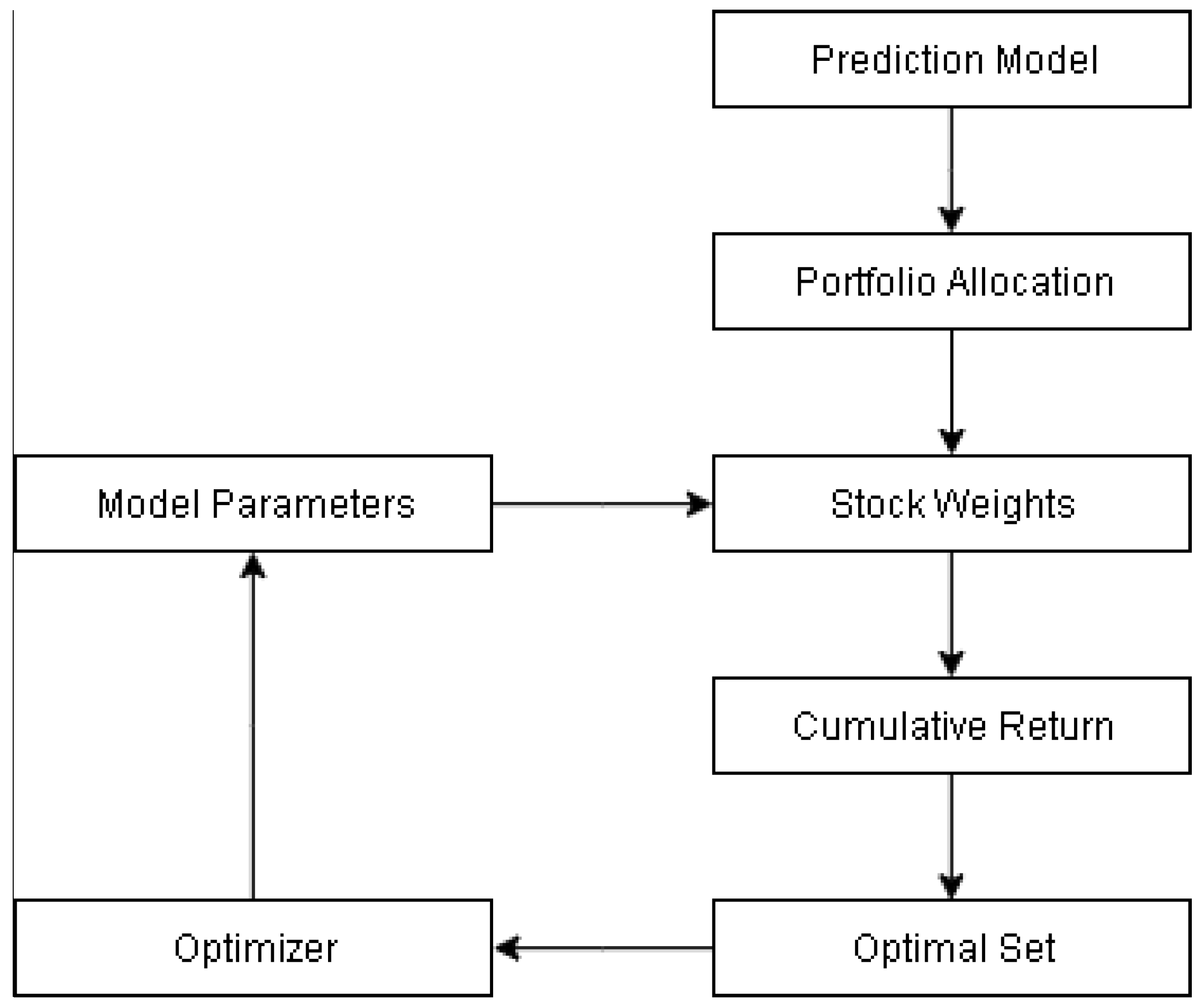

Figure A1. This figure illustrates a graphical flowchart that shows a... | Download Scientific Diagram

PDF) Portfolio Optimization in Both Long and Short Selling Trading Using Trend Ratios and Quantum-Inspired Evolutionary Algorithms

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

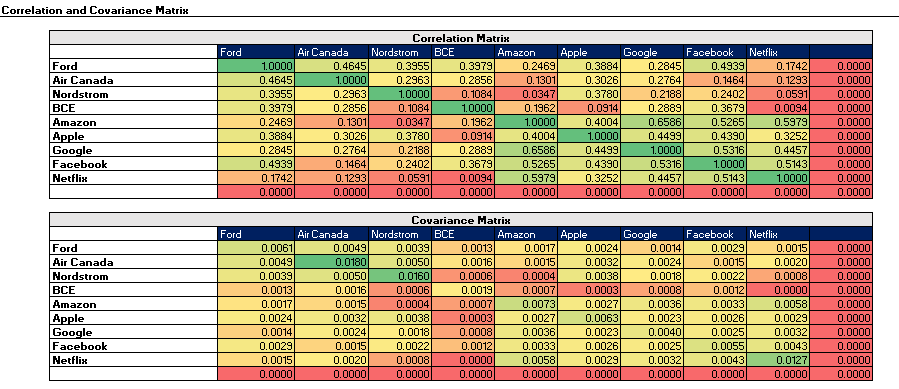

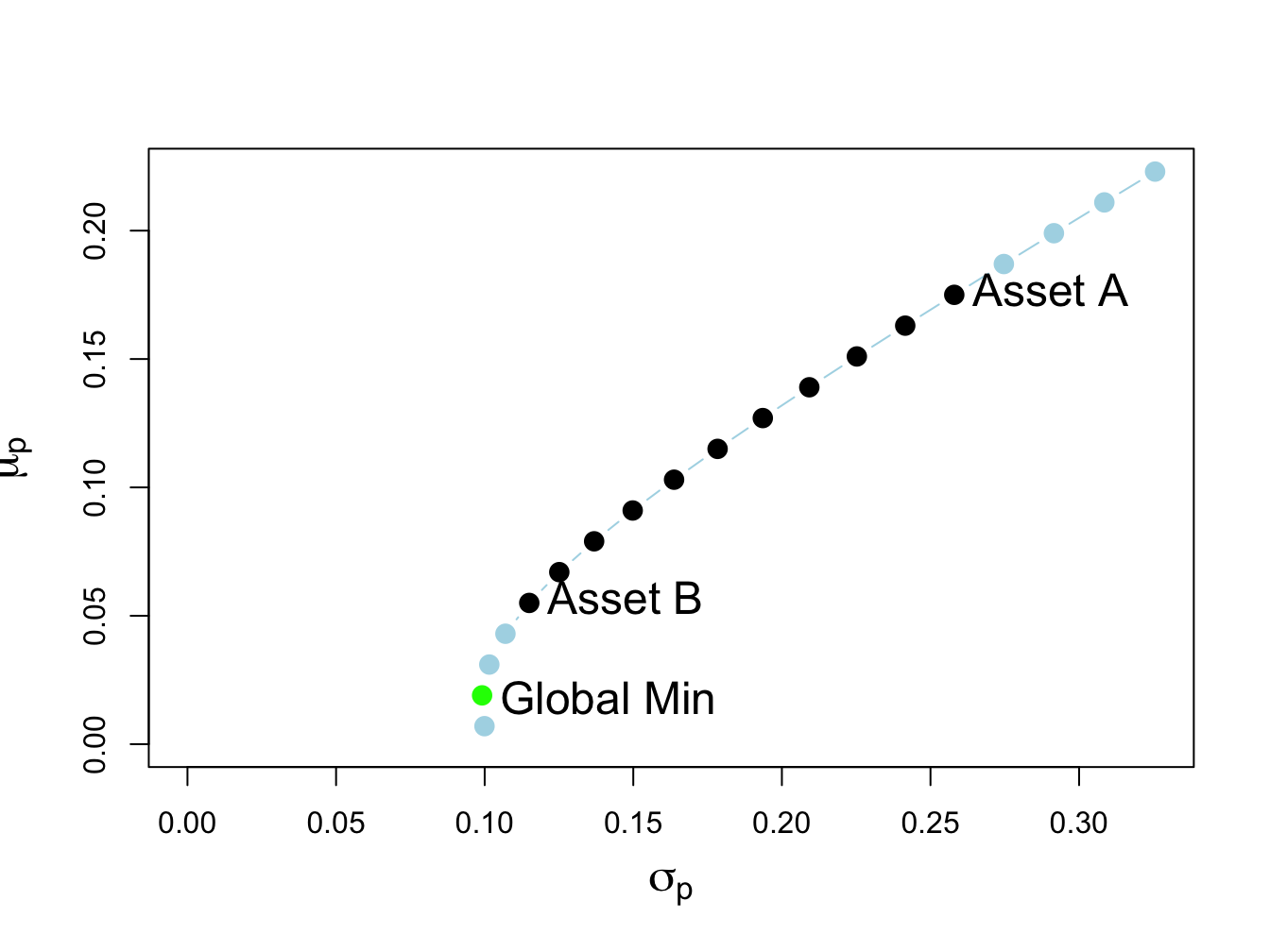

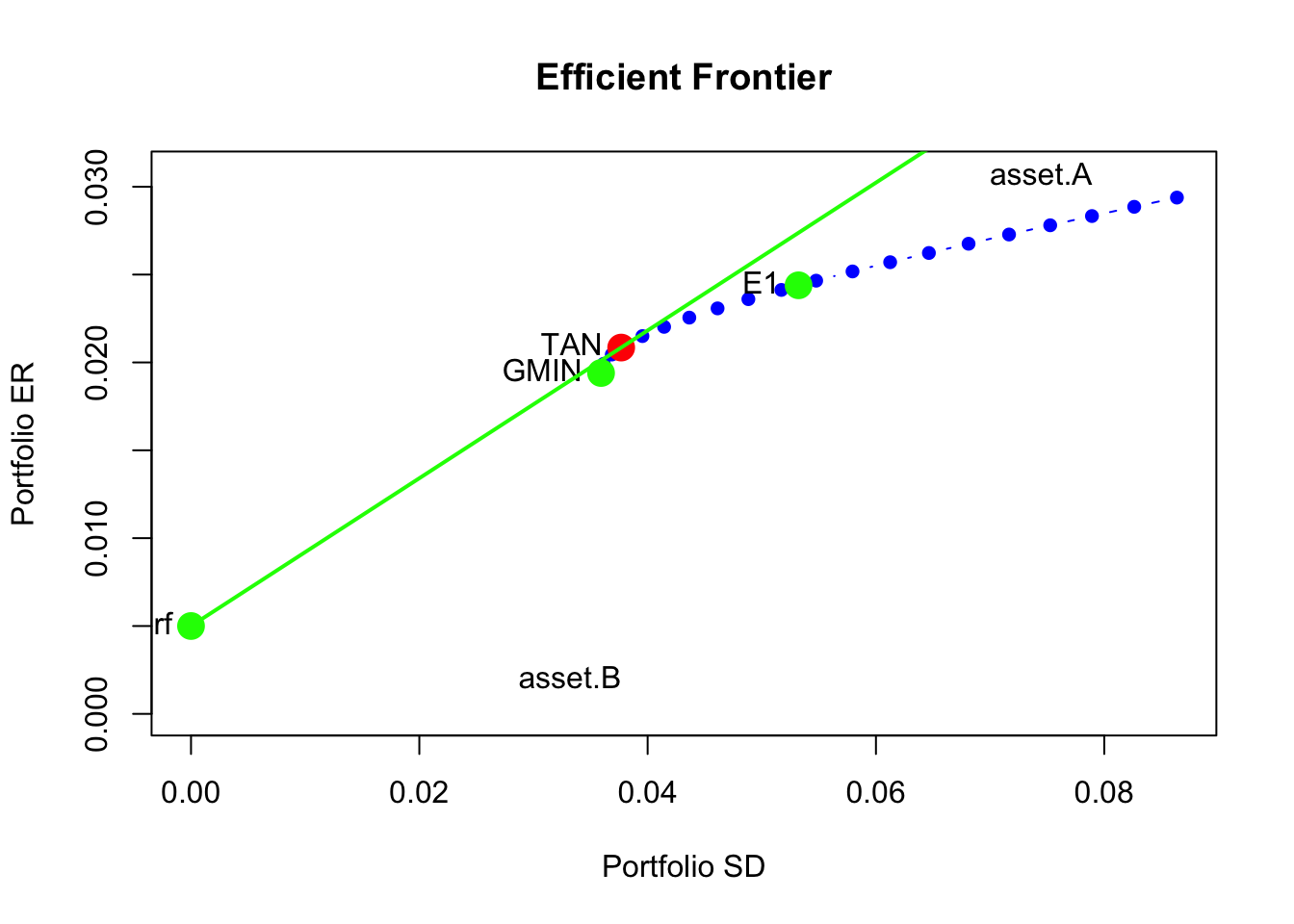

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

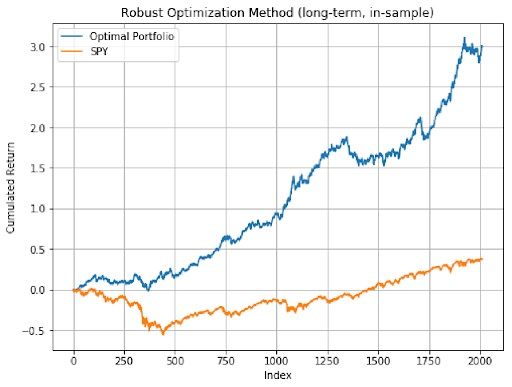

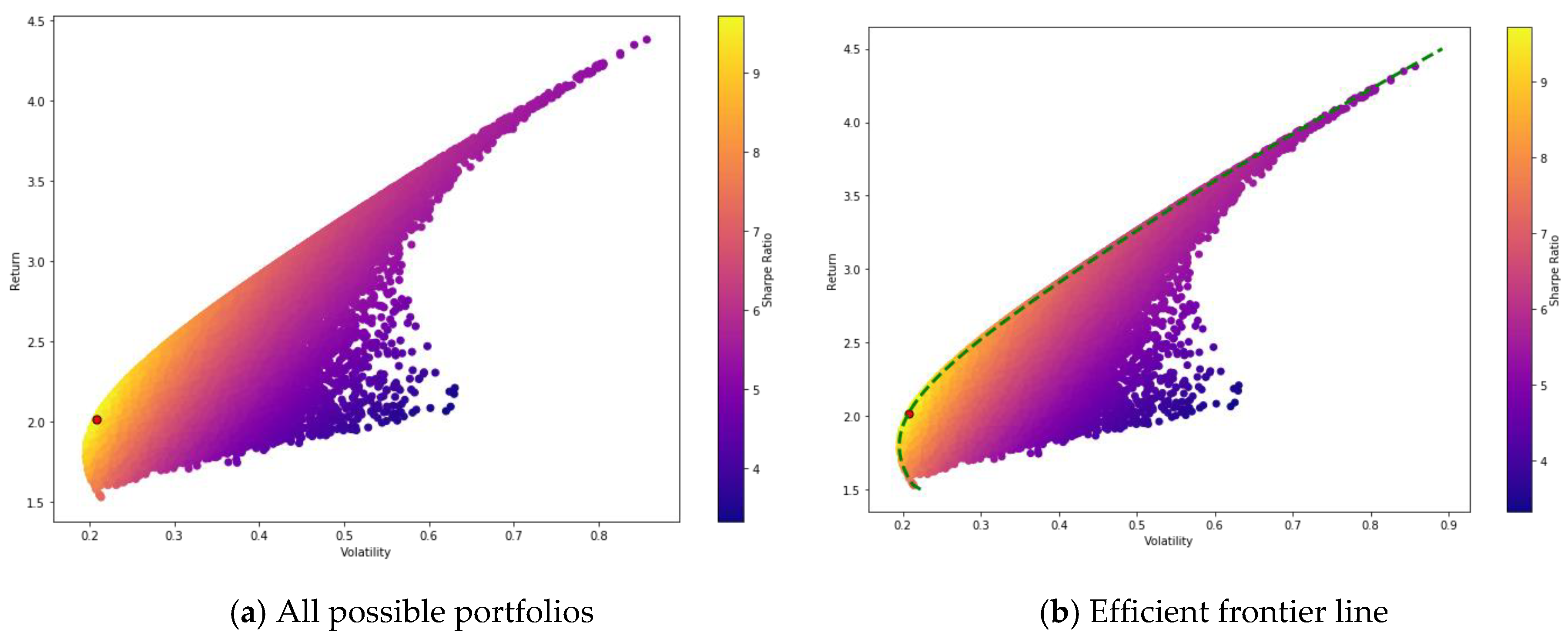

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

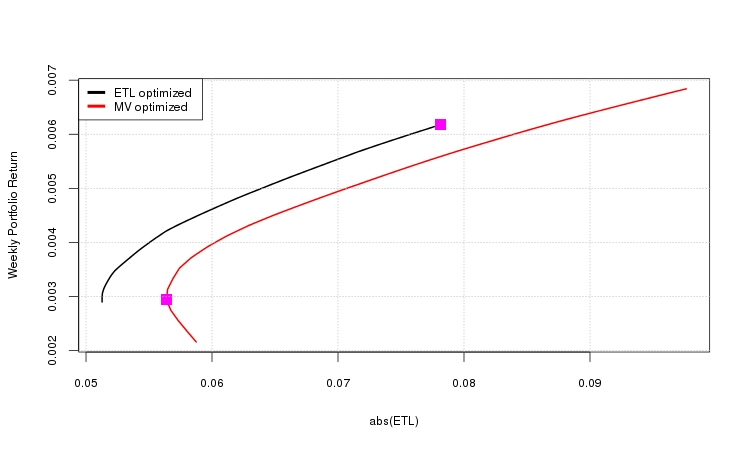

Long Short Portfolio Optimisation under Mean-Variance-CVaR Framework Gautam Mitra CARISMA, Brunel University and OptiRisk systems, UK Diana Roman CARISMA, - ppt download

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

Trimability and Fast Optimization of Long–Short Portfolios: Financial Analysts Journal: Vol 62, No 2

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R